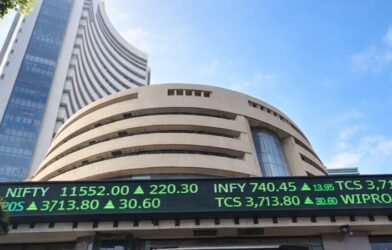

Mumbai, January 6 — Indian equity markets began Tuesday’s session on a weak note for the second straight day, with losses led by oil and gas stocks as investors stayed cautious amid global political tensions.

In early trade, the S&P BSE Sensex fell 277.45 points, or 0.32 percent, to 85,162.17. The NSE Nifty 50 was trading below the 26,200 mark at 26,199.75, down 50.55 points, or 0.19 percent.

Broader markets showed mixed movement at the open. The Nifty Midcap 100 was marginally lower, while the Nifty Smallcap 100 edged slightly higher, suggesting selective buying outside frontline stocks.

Selling pressure was most visible in the oil and gas space. Shares of Reliance Industries, Mahanagar Gas and Petronet LNG weighed on the Nifty Oil & Gas index, which fell more than 1.5 percent in early deals. Media and FMCG stocks also opened lower, while realty and consumer durable shares saw mild losses.

Gains were seen in metal and banking stocks. The Nifty Metal index led the rise, supported by buying in key metal producers. PSU banks traded higher, while pharma, private banks and IT stocks posted modest gains in early trade.

Investor sentiment continued to reflect caution after recent selling by overseas investors. On Monday, foreign institutional investors sold shares worth ₹36.25 crore, while domestic institutional investors provided support by purchasing equities worth ₹1,764.07 crore, according to exchange data.

Asian markets offered a positive lead. Major indices across the region traded higher after a firm close on Wall Street overnight. Japan’s Nikkei, China’s Shanghai Composite, South Korea’s Kospi and Hong Kong’s Hang Seng were all trading in the green during Asian hours.

US markets ended Monday’s session with gains across major indices. Energy stocks led the advance after geopolitical developments involving Venezuela pushed oil prices higher. The Dow Jones Industrial Average, S&P 500 and Nasdaq all closed higher, helping improve risk sentiment globally.

Market breadth on the NSE remained weak in early trade. Of the 2,696 stocks traded, more shares declined than advanced, indicating broader selling pressure. Several stocks touched their one-year highs and lows, while movements in upper and lower circuits remained limited.

Volatility also picked up slightly, with India VIX rising close to 2 percent, suggesting traders are factoring in near-term uncertainty.

Among Nifty 50 stocks, Trent emerged as the top loser, followed by Reliance Industries, Tata Motors passenger vehicle arm, HDFC Bank and Eternal. On the gainers’ side, Hindalco Industries, HDFC Life Insurance, Apollo Hospitals, ICICI Bank and Bajaj Auto were trading higher in early deals.

Market participants are expected to closely track global cues, crude oil prices and institutional fund flows through the day for further direction.

Comments are closed