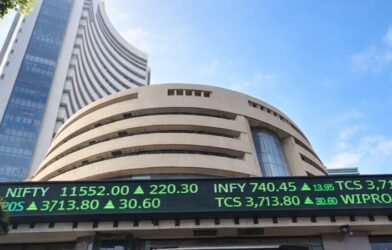

Mumbai, January 5 — Shares of HDFC Bank fell over 2 percent in early trade on Monday after the lender released its provisional business numbers for the third quarter of the financial year 2025–26. The stock declined to Rs 981.05, making it the biggest drag on the benchmark indices Sensex and Nifty.

At the same time, Union Bank of India shares rose more than 4 percent to Rs 162.99, touching a fresh 52-week high, after the state-run lender posted steady growth in its quarterly business update.

HDFC Bank reported that its average advances under management grew 9 percent year-on-year to Rs 28.64 lakh crore during the December quarter, compared with Rs 26.28 lakh crore in the same period last year. Period-end advances under management increased 9.8 percent to Rs 29.46 lakh crore, while gross advances were reported at Rs 25.43 lakh crore, reflecting an annual rise of nearly 12 percent.

On the deposit side, the bank said its average deposits rose 12.2 percent year-on-year to Rs 27.52 lakh crore. Current account and savings account deposits increased 9.9 percent to Rs 8.18 lakh crore during the quarter. Market participants appeared cautious despite the growth numbers, with analysts pointing to valuation concerns and the need for sustained improvement in margins.

Union Bank of India, which released its provisional update after market hours on January 2, reported a 7.13 percent year-on-year rise in total gross advances to Rs 10.17 lakh crore. Deposits increased 3.36 percent to Rs 12.23 lakh crore, while domestic CASA deposits grew 5 percent to Rs 4.15 lakh crore. The stock has gained in recent sessions as investors reacted positively to stable credit growth and improving balance sheet trends across public sector banks.

Among other banking stocks, Federal Bank slipped around 2 percent, while IDFC First Bank and Kotak Mahindra Bank were trading with mild losses. Shares of Axis Bank, ICICI Bank, State Bank of India, and AU Small Finance Bank rose more than 1 percent each. Bank of Baroda, Yes Bank, Punjab National Bank, IndusInd Bank, and Canara Bank were also higher by about 1 percent in a broadly mixed session for the sector.

Comments are closed